Postbank SASSA Gold Card Warning From the Reserve Bank

Postbank SASSA Gold Card Warning From the Reserve Bank. The South African Reserve Bank (SARB) has issued a firm directive concerning the Postbank SASSA Gold Card, sparking widespread attention among social grant recipients across the country. The aim is clear: to safeguard the continuous and reliable payment of social grants, especially for those who have not yet transitioned to the newer Postbank black card.

In this comprehensive guide, we’ll unpack what this development means for beneficiaries, the implications of suspending black card issuance, and what steps recipients should take to ensure uninterrupted access to their funds.

The Postbank SASSA Gold Card Mandate

The Postbank SASSA Gold Card has long served as a vital payment tool for millions of South Africans dependent on social grants. To ensure continuity, the South African Reserve Bank has instructed Postbank to keep all SASSA gold cards active. This means that beneficiaries can continue using their gold cards to withdraw money, pay for goods, and access other services without any fear of sudden termination.

Directive from SARB

The Reserve Bank’s directive is crucial for beneficiaries who have not received the updated Postbank black card. Until a revised deadline is announced, all gold cards will remain valid, and all transactions made using them must be honoured.

Temporary Suspension of Black Card Issuance

In a surprising development, Postbank has indefinitely suspended the distribution of new black cards across all branches nationwide. This decision was confirmed in an official statement by Postbank, which cited ongoing discussions with SARB as the primary reason for the halt.

“Whilst discussions are underway between SARB and Postbank, the issuing of the black cards by Postbank at their sites across the country has been suspended indefinitely.”

This unexpected pause has raised concerns among beneficiaries, many of whom were in the process of transitioning from the gold card to the black card.

SASSA Assures Continued Grant Payments

Despite the uncertainty surrounding the rollout of black cards, the South African Social Security Agency (SASSA) has assured grant recipients that there will be no disruption to social grant payments. The agency emphasized that all beneficiaries have the right to receive their grants through any bank of their choice.

What Beneficiaries Should Do:

- If you still have a Postbank SASSA Gold Card, continue using it as usual.

- If you wish to switch to another bank account, you can do so freely.

- For assistance, visit your nearest SASSA local office.

This assurance is vital for millions of grant recipients who rely heavily on their monthly disbursements for basic survival.

Concerns from Parliament’s Social Development Committee

Adding to the conversation, Bridget Masango, Chairperson of Parliament’s Portfolio Committee on Social Development, voiced concerns about the halt in black card issuance. She warned that this could negatively affect vulnerable beneficiaries and lead to confusion if not properly managed.

She stressed the importance of ensuring gold card validity and maintaining public confidence in the payment system:

“While we understand the complexities that surround this process, it is important to ensure that assurance is given to beneficiaries that there will be no disruptions in their use of the gold card and that they will receive their monies,” said Masango.

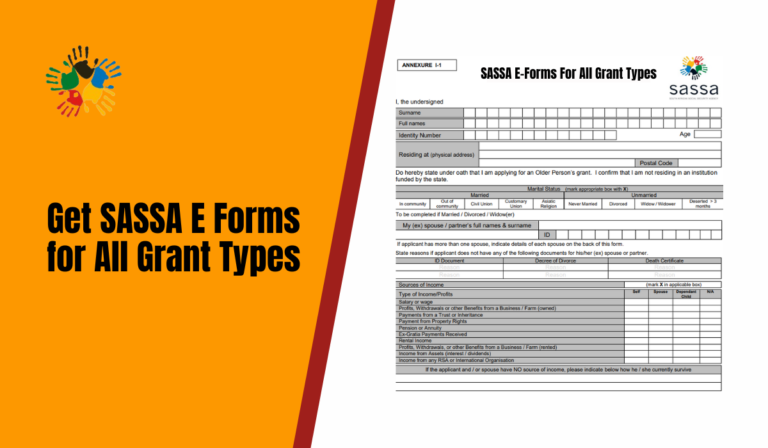

Comparison Between SASSA Gold Card and Black Card

To better understand the current situation, let’s compare the features and roles of both card types.

| Feature | SASSA Gold Card | Postbank Black Card |

|---|---|---|

| Issuing Institution | Postbank | Postbank |

| Current Status | Active and Valid | Issuance Suspended |

| Usability | ATMs, Retailers, and Post Offices | Similar, with enhanced features |

| Deadline for Discontinuation | Postponed – SARB to announce new date | Not currently being issued |

| Associated Risk | Risk of expiry without notice | Delay in rollout may affect new recipients |

How to Switch Your SASSA Payment Method

With the uncertainty around card replacements, beneficiaries are advised to consider switching their grant payments to a personal bank account. Here’s a simple guide on how to do it:

Step-by-Step Guide

- Visit the Nearest SASSA Office

Bring your ID, proof of residence, and your current gold card. - Request to Change Your Payment Method

Indicate that you wish to have your grant paid into your own bank account. - Submit Your Bank Details

Provide an official bank confirmation letter or a stamped bank statement. - Wait for Processing

It may take up to 30 days for the change to reflect, so plan accordingly.

Why This Matters for Millions

According to official statistics, over 18 million South Africans receive social grants. Many of these individuals live in rural or under-resourced areas and may not have immediate access to banking services. A disruption in grant payments, even for a few days, can have devastating effects.

By keeping the Postbank SASSA Gold Card operational and suspending the black card rollout temporarily, SARB and Postbank aim to avoid large-scale disruptions and allow more time for a smoother transition in the future.

Conclusion

Although Postbank has not given a definitive timeline for the black card rollout resumption, SARB’s involvement signals a strong commitment to protecting the interests of grant recipients. Meanwhile, beneficiaries are encouraged to stay informed, use their current Postbank SASSA Gold Cards, and exercise their right to choose a different bank if needed.